Developing the Annual Budget

The development of Jupiter Bay's Annual Budget is a tedious and complex process requiring the use of interrelated spreadsheets that analyze current year expenditures, predict probable cost increases, and calculate revenues and fees needed to fund projected expenses.

The development of Jupiter Bay's Annual Budget is a tedious and complex process requiring the use of interrelated spreadsheets that analyze current year expenditures, predict probable cost increases, and calculate revenues and fees needed to fund projected expenses.

Budget Purpose

The Association’s annual budget is a plan which anticipates revenues and expenses for the upcoming year. It also serves as a benchmark by which to compare the Board’s stewardship of the financial assets of the association.

The budget provides for control over certain restricted funds of the association (i.e., reserves). It also identifies how much money (via maintenance assessments) must be collected from the unit owners. Basically, the budget is simply a map that will guide the board and management office in making decisions during the course of the year.

The budget covers an annual operating period known as the fiscal year. Jupiter Bay’s fiscal year is the calendar year (January 1 through December 31).

Multicondominium Accounting

The Association maintains nine sets of accounting records, one set for the master association (known as Class B income & expenses in the Association’s Bylaws) and separate records for each of the eight individual associations (Class A income & expenses).

The Association's annual budget determines, for each of the 8 individual associations and common elements:

1. How much money is allocated to each of the various operating expense items,

2. Funding for the reserves (deferred maintenance & capital expenditure items), and

3. Quarterly owner maintenance assessments.

Budgeting, a 3-Step Process

This webpage describes the condominium association's annual budgeting as a 3-step process:

A. Determine operating expenses for the next budget year by analyzing current year expenses and researching possible cost increases. (See below)

B. Determine reserve expenses for the next budget year based on known capital expenditures, inflation, and possible reserve studies. (See adjacent column)

C. Based on steps A & B, calculate maintenance assessments by adding projected common and building expenses, both operating and reserve. Divide the result by the number of association members. (See adjacent column)

Automating the Budget Process

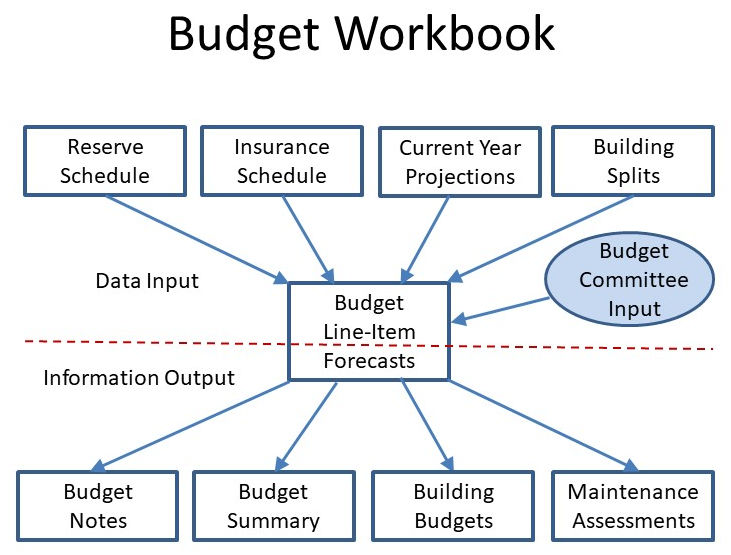

Preparation of the Annual Budget can be simplified, with changes reflected instantly, through use of a series of interlinked Excel spreadsheets. This process uses historical known information, such as the reserve schedule, data collected from insurance vendors, and 9 months of current-year expenses and combines it with Budget Committee input to produce all of the spreadsheets for the next year's budget. Quarterly Assessments are calculated automatically as a byproduct of the budgeting process, allowing various "what-if" line-item change scenarios.

The Budget Committee uses comparison data, provided by the Budget Workbook, for each line item showing last year's budget figure and current year expense projection to enable them to see and respond to changes and trends.

Budget Process -- (A) Operating Expense

Budgets are determined by prior period actual expenses adjusted for inflation and other known factors. The process generally consists of the following steps:

1. Obtain year-to-date operating expense information (or expense information for the preceding 12 months) for the entire Association (not individual buildings or common elements at this step).

2. If using year-to-date expense data, project full-year expenses by:

- Assuming monthly averages for the remaining months, and

- Manually adjusting for any known expense variations in these remaining months.

3. Steps #1 and #2 provide a baseline budget for the new year.

4. Calculate annual totals for each baseline expense account.

5. Review the total annual projected expenditure for each account (expense line item), and adjust as necessary for inflation, known increases/decreases, and other factors. (These adjustments can be dollar values or percentages).

6. Compare expense totals with the prior year’s budget for reasonableness. Try to stay within the rate of inflation. (Note that budgets exceeding 115% of the prior year’s budget require membership approval.)

7. Determine which expenses are for the community shared common areas (Class B) and which are for individual association/building common areas and limited common areas (Class A). Class B expenses typically include:

- Administration (accounting fees, audit, legal, office supplies, bank charges and board expense);

- Payroll (salaries, benefits, workers comp, payroll taxes and payroll processing);

- General Insurance (boiler & machinery, directors & officers, crime, island marine, umbrella & insurance finance charge);

- Common Repair & Maintenance;

- Security Contracts;

- Equipment Rental & Supplies;

- Maintenance & Janitorial Supplies;

- Lake/Irrigation Maintenance;

- Landscaping Contract & Services;

- Pool & Tennis (supplies & maintenance);

- Telephone; and

- Tax (federal income & FL condo tax).

8. Next, address the Class A (building common) expenses and determine how they are to be allocated across the 8 individual associations. This is done by calculating the percent of total expenses (by expense line) consumed by each association/building during the prior 12 months (or year to date). The primary Class A expense allocation percentages are calculated as follows:

- Property & Liability Insurance – From actual prior year P&L costs according to amount of insured value (see insurance broker’s binder).

- Wind Insurance – From actual prior year insurance costs per building (see insurance broker’s binder).

- Building Repair & Maintenance – Prior 12 months of actuals for each association/building.

- Licenses & Fire Inspection Fees –Prior 12 months of actuals for each association/building.

- Fire Alarms & Sprinklers – Prior 12 months of actuals for each association/building (excluding villas).

- Elevator Maintenance & Repair – Based on East and West elevator contracts. West contract costs are split among the 6 West buildings.

- Generator Maintenance & Repair – 100% of this cost (including generator fuel) is allocated to the East.

- Trash Removal & Recycling – Split based on number of units per building. (Each unit pays 1/359th.)

- Pest Control – Split based on number of units per building. (Each unit pays 1/359th.)

- Utilities – Split all utility (water, electricity, sewerage, cable TV) expenses based on number of units per building. (Each unit pays 1/359th.)

9. Develop operating expense budgets for each of the 8 individual associations:

- Allocate all Class B (community shared common area) expenses to each association – Allocate 37.602% (135/359) to the East and 8.914% (32/359) to each pf the other 7 associations.

- Allocate Class A (building common) expenses using the percentages from Step #8 above.

10. You now have estimated Operating Expense budgets for the master association and each of the 8 individual/building associations.

Budget Process -- (B) Reserve Expense

11. The other section of the budget is the reserve section. The reserve section contains funds that are set aside (restricted) for specific expenditures that will be incurred in the future. Usually, such expenditures relate to the cost of major repairs to, or replacements of, the condominium property. If money is not set aside for these expenses, unit owners will usually have to pay a special assessment at the time such repair or replacement occurs.

- The Condominium Act requires that reserves be established for certain items including: roof replacement, building painting, pavement resurfacing and any other item of capital expenditure or deferred maintenance that exceeds $10,000. Jupiter Bay has established additional reserves (see below) for other community and building capital expenditures and deferred maintenance. Deferred maintenance means any maintenance or repair that will be performed less frequently than yearly, and will result in maintaining the useful life of an asset.

12. Jupiter Bay maintains the following Community Common-Area reserve accounts: Restoration (bridge, lake and waterfall), East & West Pools, Irrigation, Paving, and Common Buildings (pool, maintenance shed & pump house).

13. Jupiter Bay maintains the following Building-Related reserve accounts: Building Restoration, Elevators, Building Painting, Roof Replacement, and Generator & Booster Pumps (East only).

14. Determine Replacement Cost and Years of Life for each reserve item (both common reserves and reserves for each individual association/building):

- Replacement Cost is determined by actual prior expenditures (with an inflation adjustment) or current vendor quotes. Once established, the Replacement Cost may increase slightly due to inflation but would not change substantially from year to year.

- Years of Life is determined by historical experience, vendor input and from experiences of other similar associations. The following Years of Life values are commonly used: Paint (5-7 yr.), Roof (12-20 yr.), Elevator (20-25 yr.), Spalling (12-18 yr.), Pools (10-15 yr.), and Paving (18-22 yr.).

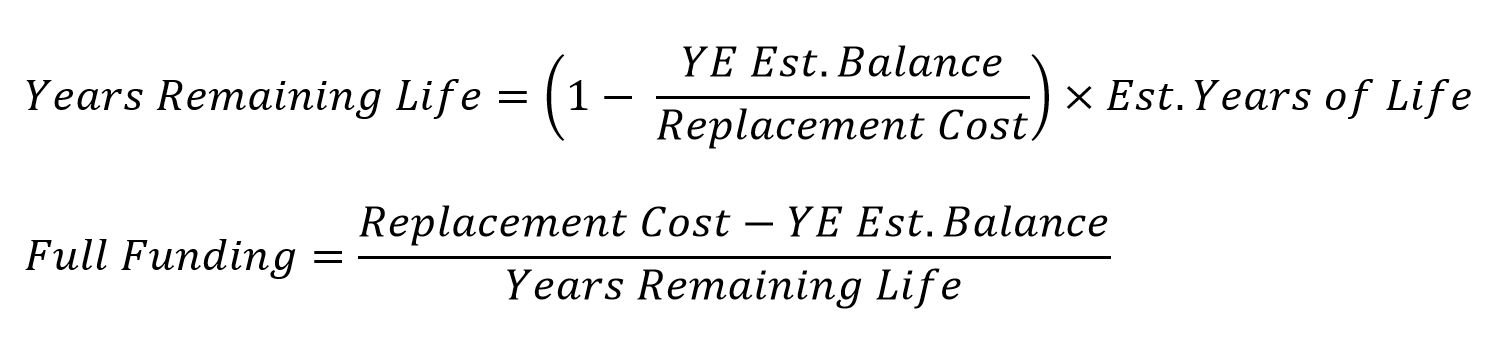

15. Years Remaining Life and Full Funding of reserves for the new year are calculated mathematically to reflect the requirements to reach full replacement cost based on current balance:

Following is a sample Reserve Schedule, using the formulas above, for the Association’s Common Areas:

| Reserve Fund | Prior Yearend Balance | Replacement Cost | Years Of Life | Years Left (Calc.) | Full Funding Contr. |

| Restoration - Bridge, Lake, Tennis, Bocce | 7,395 | 109,374 | 6 | 6 | 18,229 |

| East & West Pools - Resurface, Deck, Furniture | 58,646 | 162,216 | 10 | 6 | 16,222 |

| Irrigation | 14,060 | 32,828 | 8 | 5 | 4,104 |

| Paving | 184,814 | 770,461 | 22 | 17 | 35,021 |

| Common Buildings | 8,765 | 105,621 | 18 | 15 | 6,457 |

| Totals | 273,680 | 1,180,500 | 80,033 |

16. If a reserve fund balance is negative, the total amount necessary to bring a negative account balance to zero must be added to the Full Funding calculation.

17. Allocate Common Reserve funding expenses to each association – 37.602% (135/359) to the East and 8.914% (32/359) to the other 7 associations.

Budget Process -- (C) Maintenance Assessments

18. Finally, determine whether Miscellaneous Income should be included for the 8 individual associations. This would include late fees, interest on owner delinquencies, West C transfer fees, etc. Any miscellaneous income is shown as a negative number to offset expense.

19. Now that the operating and reserve expenses and miscellaneous income are known for each association, it’s time to calculate the assessments needed to cover expenses. The following table is used for this (where Total Annual Expense is the sum of the five columns):

| Assoc. / Bldg. | Common Expenses | Building Expenses | Misc. Income | Total Annual | ||

| Operating | Reserves | Operating | Reserves | |||

| East | ( ) | |||||

| Villas | ( ) | |||||

| West A | ( ) | |||||

| West B | ( ) | |||||

| West C | ( ) | |||||

| West D | ( ) | |||||

| West E | ( ) | |||||

| West F | ( ) | |||||

| TOTAL | ( ) | |||||

20. The Association’s Annual Budget is the sum of the total expenses for the 8 individual associations.

21. Now divide the Total Annual Expense for each individual association by the number of units in the association (135 for the East and 32 for the other buildings) to obtain annual maintenance fees. Divide this by four to get quarterly maintenance figures.

22. Compare the new maintenance figures with prior year figures to determine reasonableness. Make budget adjustments as necessary.

23. The calculated maintenance fees will provide sufficient income to cover the Association’s annual expense for the new year.

Budget Planning & Meetings

It is a good idea to start gathering information needed to prepare the proposed budget 3-4 months before it becomes effective. This should provide plenty of time to compare historical budget versus actual performance, research the payment histories of association members, identify and talk to key people about the costs of equipment and services, and determine whether additional expenditures are needed to maintain the property, etc. Also, it’s important to provide sufficient time for Board review, owner budget correspondence, budget approval meeting, and coupon book printing/distribution.

The budget will be prepared by and/or reviewed by a Budget Committee, which will be chaired by the Treasurer and consist of at least five total members, only two of which can be Board Directors.

The Treasurer should call the first meeting of the Budget Committee in late September or early October. All meetings of the Budget committee that will be making recommendations to the board regarding the association budget are subject to the same provisions of a board meeting. This requires an adequate notice which must specifically identify all agenda items and be posted conspicuously on the condominium property at least 48 continuous hours before the meeting except in an emergency. Budget Committee meetings are open to all owners; however, due to the amount of detailed material to be covered, owner participation may be limited.

Budgets will be adopted at a board meeting held sufficiently prior to year end to assure that the new budget and maintenance fees can be distributed to condominium owners prior to the start of the new budget year. Note that this is an exception to the Jupiter Bay Bylaws, paragraph 9.4(g), that says “Copies of Class A Budgets and proposed assessments under the Class A Budget shall be transmitted to each Unit Owner in the Condominium for which the Class A Budget is formulated on or before September 1st preceding the year for which the Budget is made.”

Any meeting at which a proposed annual budget of an association will be considered by the Board or unit owners shall be open to all unit owners. At least 14 days prior to such a meeting, the Board shall hand deliver to each unit owner, mail to each unit owner at the address last furnished to the association by the unit owner, or electronically transmit to the location furnished by the unit owner for that purpose a notice of such meeting and a copy of the proposed annual budget. An officer or manager of the association, or other person providing notice of such meeting, shall execute an affidavit evidencing compliance with such notice requirement, and such affidavit shall be filed among the official records of the association.

Jupiter Bay's Budgets 2009 - 2024

Following are Jupiter Bay Budgets for the past 16 years:

| Year | Operating Expense | Reserve Expense | Total Budget | Budget Increase | % Increase | Special Assessments | |

| 2009 | 1,480,485 | 172,300 | 1,652,785 | 339,480 | West Elevators | ||

| 2010 | 1,553,380 | 197,850 | 1,751,230 | 98,445 | 5.96% | --- | --- |

| 2011 | 1,608,620 | 191,680 | 1,800,300 | 49,070 | 2.80% | 162,000 | East Concrete Restore |

| 2012 |

1,597,700 | 233,190 | 1,830,890 | 30,590 | 1.70% | 90,765 | Operating Budget |

| 20,000 | Common Reserves | ||||||

| 2013 | 1,529,157 | 293,139 | 1,822,296 | (8,594) | -0.47% | --- | --- |

| 2014 | 1,519,213 | 382,127 | 1,901,340 | 79,044 | 4.34% | 143,104 | Villas Restore |

| 2015 | 1,519,435 | 382,127 | 1,901,562 | 222 | 0.01% | --- | --- |

| 2016 | 1,565,759 | 412,105 | 1,977,864 | 76,302 | 4.01% | 19,200 | West F Legal |

| 2017 | 1,588,604 | 443,248 | 2,031,852 | 53,988 | 2.73% | --- | --- |

| 2018 | 1,701,294 | 489,424 | 2,190,717 | 158,865 | 7.82% | 75,390 | Lake Irrigation |

| 2019 | 1,765,256 | 515,028 | 2,280,284 | 89,567 | 4.09% | 236,529 | Operating Budget |

| 2020 | 1,915,843 | 543,261 | 2,459,104 | 178,820 | 7.84% | --- | --- |

| 2021 |

1,897,856 | 660,803 | 2,558,659 | 99,555 | 4.13% | 165,796 | Insurance |

| 80,914 | West F Reserves | ||||||

| 2022 | 1,950,440 | 713,127 | 2,663,567 | 104,908 | 4.10% | 349,181 | Insurance |

| 2023 |

2,395,176 | 714,304 | 3,109,480 | 445,913 | 16.74% | 610,309 | Insurance |

| 185,461 | West Roofs | ||||||

| 2024 | 3,060,717 | 584,817 | 3,645,534 | 536,054 | 17.24% | --- | --- |

The development of Jupiter Bay's Annual Budget is a tedious and complex process requiring the use of interrelated spreadsheets that analyze current year expenditures, predict probable cost increases, and calculate revenues and fees needed to fund projected expenses.

The development of Jupiter Bay's Annual Budget is a tedious and complex process requiring the use of interrelated spreadsheets that analyze current year expenditures, predict probable cost increases, and calculate revenues and fees needed to fund projected expenses.