The following information on the leasing of Jupiter Bay condominium units by owners and rental agents is provided:

» Jupiter Bay Condominium Association's Rental Policy » Condominium Unit Rentals (Frequency, Times & Length) » Agencies that Rent Units for Jupiter Bay Owners » Units Rented & Not Rented and Type of Ownership » Parking Permit Processing » Condominium Unit Sales » Condominium Ownership » ConclusionsTenant's Rights

FL Statute 718.106(4) says “When a unit is leased, a tenant shall have all use rights in the association property and those common elements otherwise readily available for use generally by unit owners and the unit owner shall not have such rights except as a guest, unless such rights are waived in writing by the tenant. Nothing in this subsection shall interfere with the access rights of the unit owner as a landlord pursuant to chapter 83. The association shall have the right to adopt rules to prohibit dual usage by a unit owner and a tenant of association property and common elements otherwise readily available for use generally by unit owners.

Introduction

For the past 20 years, the Jupiter Bay Condominium Association’s receptionist has been tracking the issuance of Parking Permits and related leases on an Excel spreadsheet. The data includes date, permit #, unit, renter’s/guest’s name, vehicle identification (make, model, license # & state), unit owner’s name, rental agent and lease period.

In 2008, 2010, 2013, 2018 & 2022 this permit/lease data was analyzed to determine vehicle parking and unit leasing information to help Association management:

- Understand the composition of the residents and vehicle parking, and

- Provide requested data to prospective owners, real estate agents and mortgage lenders.

This report (below) uses 2019-2022 leasing data and QuickBooks unit ownership data to update permit/leasing/sales information and provide perspective on demographic changes occurring within the Jupiter Bay community.

Short Term Rentals in PBC

Condominium owners who offer accommodations for short term rentals (six months or less) are required to collect Tourist Development Tax (TDT), which is 6% of the total taxable rental receipts. TDT is an add-on tax and is collected from the tenant at the time rent or accommodation charges are collected.

Jupiter Bay property owners who rent their unit(s) for periods of six months or less must:

- Establish an online Tourist Development Tax account with the Palm Beach County Tax Collector at www.pbctax.com/tdt.

- Obtain a county Local Business Tax Receipt (BTR) for Short Term Rental for each short-term rental property.

Jupiter Bay Unit Composition Summary

| 221 Units Rented in 2022 | # of Units | % of Units | |

| Annual Rental Units | 18 | 5.0 | |

| Other Investor Units | 127 | 35.4 | |

| 2nd Home w/Some Rentals | 76 | 21.2 | |

| 138 Units Not Rented in 2022 | |||

| Primary Home | 68 | 18.9 | |

| 2nd Home Not Rented | 70 | 19.5 | |

Leasing of Jupiter Bay's Condominium Units

- Paragraph 10.1 of the Association’s Declaration says that “Leasing or renting of a condominium unit by a Unit Owner is permitted.” Consequently, Jupiter Bay has few restrictions and many rentals.

- A 2002 Arbitrator Ruling said that the Association can enforce occupancy limits and require that leases be in writing and filed with the Association prior to occupancy by the tenant, not less than 3 business days in advance of the intended occupancy.

- Because of Jupiter Bay's liberal rental policy, it is classified under Florida Statute 509 as a “Transient public lodging establishment”. This definition applies to any unit, group of units, dwelling, building, or group of buildings within a single complex of buildings which is rented to guests more than three times in a calendar year for periods of less than 30 days or 1 calendar month, whichever is less, or which is advertised or held out to the public as a place regularly rented to guests.

- The Jupiter Bay Condominium Association does not lease units. Owners who lease their units do it themselves or work through a rental agency.

- 22 different rental agencies were used by JB owners in 2022. No agent is affiliated with or endorsed by the Association.

- Services provided by these agents varies by rental company and unit and could include:

-

- Obtaining tenants & securing leases,

- Property management & repair, and

- Unit remodeling/upgrading.

Jupiter Bay's Rental Restrictions

- Occupancy limits – Occupancy is limited to 4 persons for a one-bedroom unit and 6 persons for a two-bedroom unit.

- Leases – Must be in writing and filed with the Association prior to occupancy by the tenant, not less than 3 business days in advance of the intended occupancy. (No Association approval)

- Parking permits – Required for all vehicles that park overnight on association property. Certain trucks can be operated and parked in designated spaces on association property. Larger trucks, vans, tractors, and recreational vehicles may not be used, operated, stored or parked on condominium property except for short-term delivery and contractor vehicles. There is a $25.00 parking decal issuance fee.

- Domestic household pets – Not to exceed 20 pounds are permitted. When outside the unit, pets must be on a leash or under the owner’s direct control.

- The West C Association has several additional restrictions:

-

- Rentals must be for at least 30 days except for several holiday rental exceptions.

- All rentals must be reviewed and approved in advance by the Association.

- Unit sales require a $100 transfer fee, 1st time renters of a unit are charged a $75 processing fee, and owner Guests not residing with the owner must pay a $25 fee.

-

The Following Information is based on 2022 leasing and ownership data...

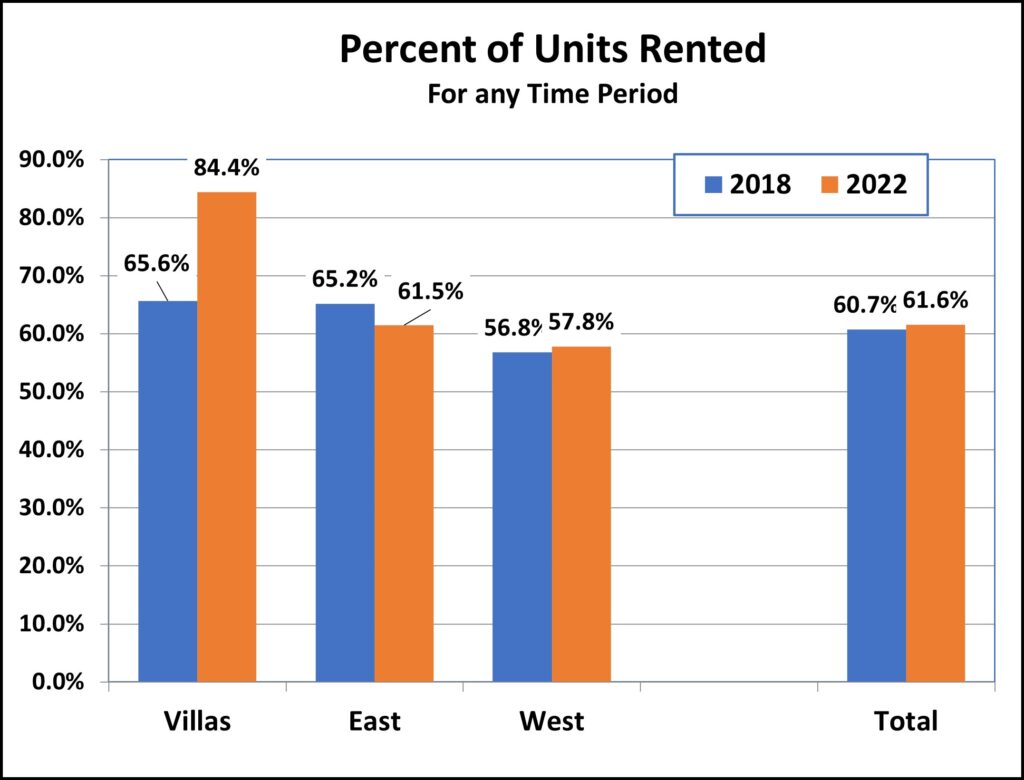

Condominium Unit Rentals (2018 vs 2022))

Condominium Ownership/Usage

- 221 condominium owners (61.6%) rented their unit(s) at least once in 2022.

- This is up from 218 owners (60.7% in 2018 and up from 199 owners (55.4%) in 2013 (9 years earlier).

- The Villas had the greatest increase where 6 additional units became rentals.

- 138 condominium owners (38.4%) did not rent their units at all in 2022.

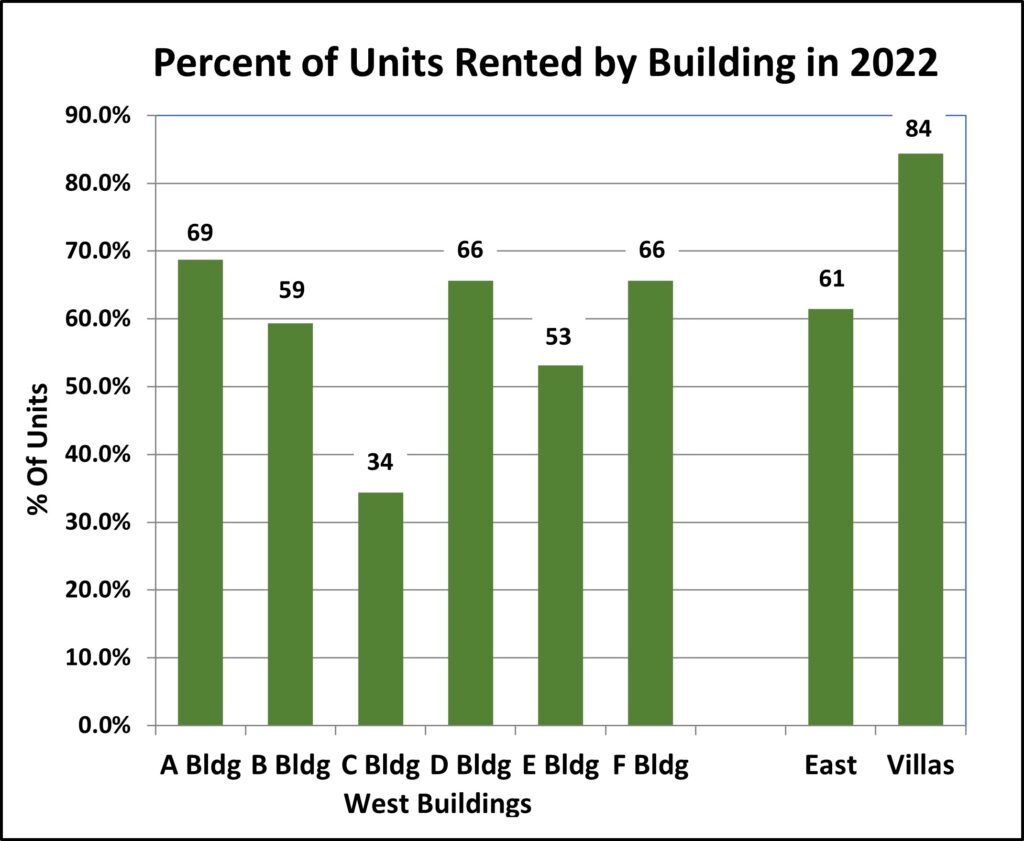

Associations & West Building-by-Building Comparison

Condominium Usage by Association

- This chart shows all 8 Jupiter Bay associations.

- Half of the West units (A, D & F) have more rentals than the East, and the other half have less.

- Building A was the most rented West building in 2022 (22 units), and building C, which has the most stringent rental rules, was the least rented (11 units).

- The number of units rented in 5 of the 8 associations has increased over the last 4 years. The number of West C rentals has decreased by 2 units.

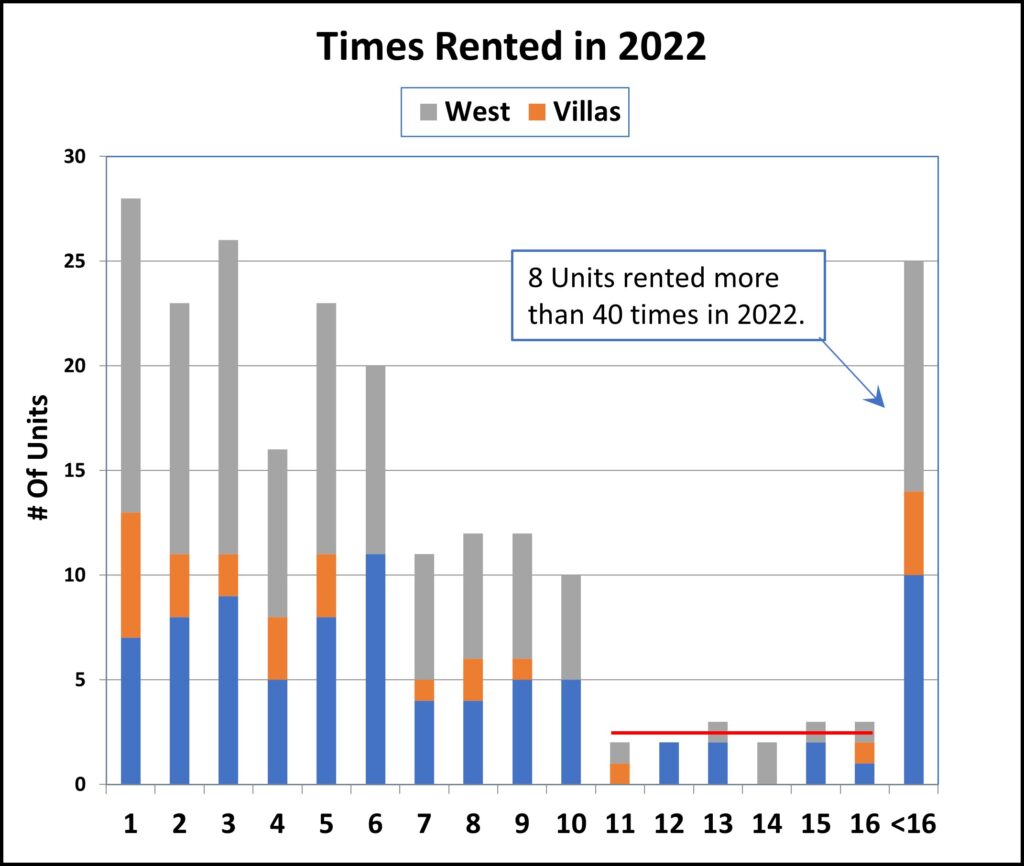

Overall Number of Rentals

Quantity of Rentals

- 28 units were only rented once in 2022. (18 of these were annual rentals.)

- Most leased units (136) were rented 6 times or less.

- The chart shows 3 groupings:

- 1-6 rentals averaging 22.7 units

- 7-10 rentals averaging 11.3 units

- 11-16 rentals averaging 2.5 units

- Units rented more than ten times:

- 40 units in 2022

- 30 units in 2018

- 19 units in 2013

- There has been a significant increase in short-term rentals over the past 9 years.

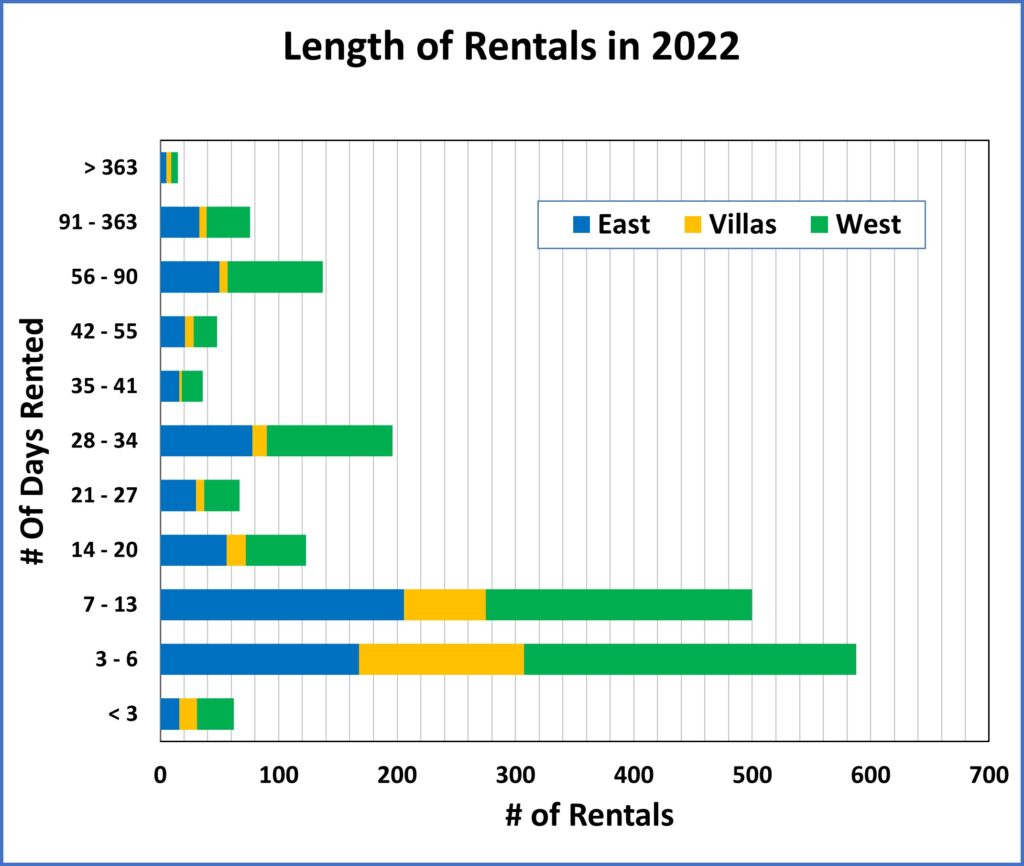

Length of Condo Unit Rentals

Days Rented per Lease

- The typical rental period in 2022 was for less than a week (35.2% of rentals) followed by weekly rentals (27.1%)

- Nine years ago (2013) only 89 rentals were for less than a week.

- In 2018 the typical rental was for 1 - 2 weeks (32.6% of rentals) followed by 4 - 6 weeks (20.7% of rentals)

- 54.2% of Villa rentals were for less than a week. (As shown previously, this was driven by 3 Villa owners)

- 196 (10.6%) were monthly rentals, and 18 rentals were annual (up from 15 in 2018).

Top 6 Sources of Rentals at Jupiter Bay

221 Units were Rented in 2022

- Jupiter Bay homeowners used 22 different rental agencies in 2022, one less than they used in 2018 and 4 more than used in 2013.

- Most owners used the following 5 agencies: JBR, JLR, Poshpadz, FPB Investment Properties, and Coldwell Banker.

- Three agencies had the most rentals:

- 28.9% - Jupiter Bay Resort (JBR),

- 6.4% - Poshpadz, and

- 5.8% - Jupiter Lighthouse Realty (JLR)

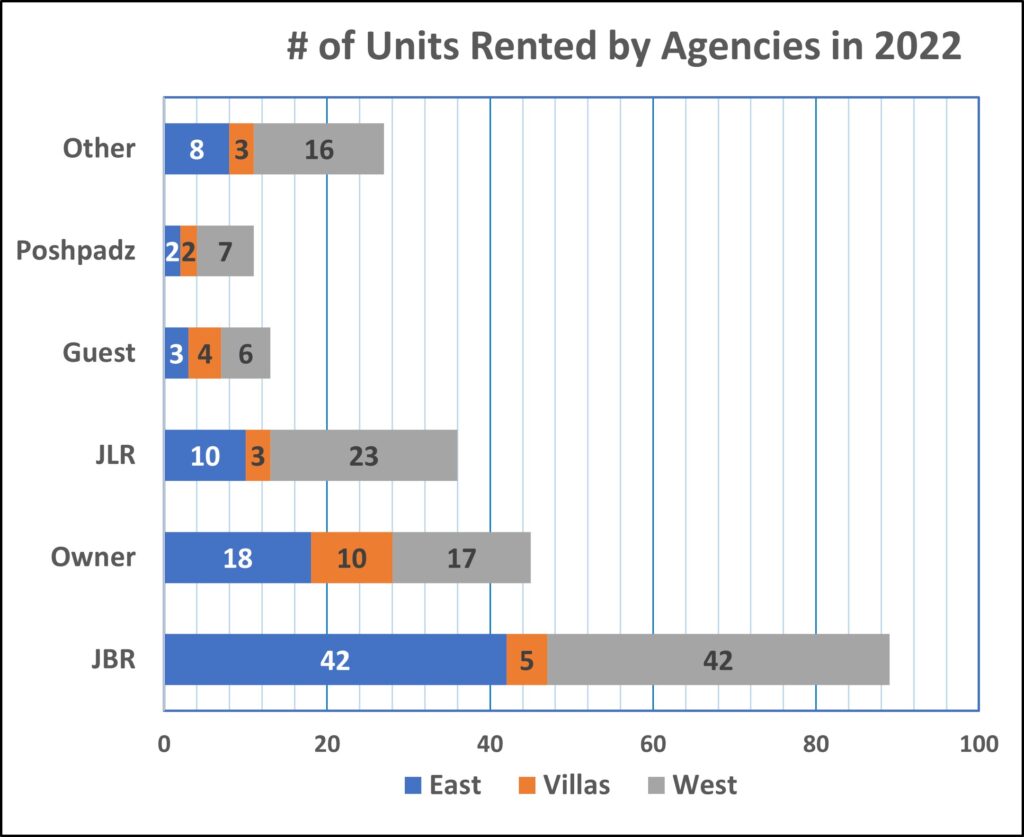

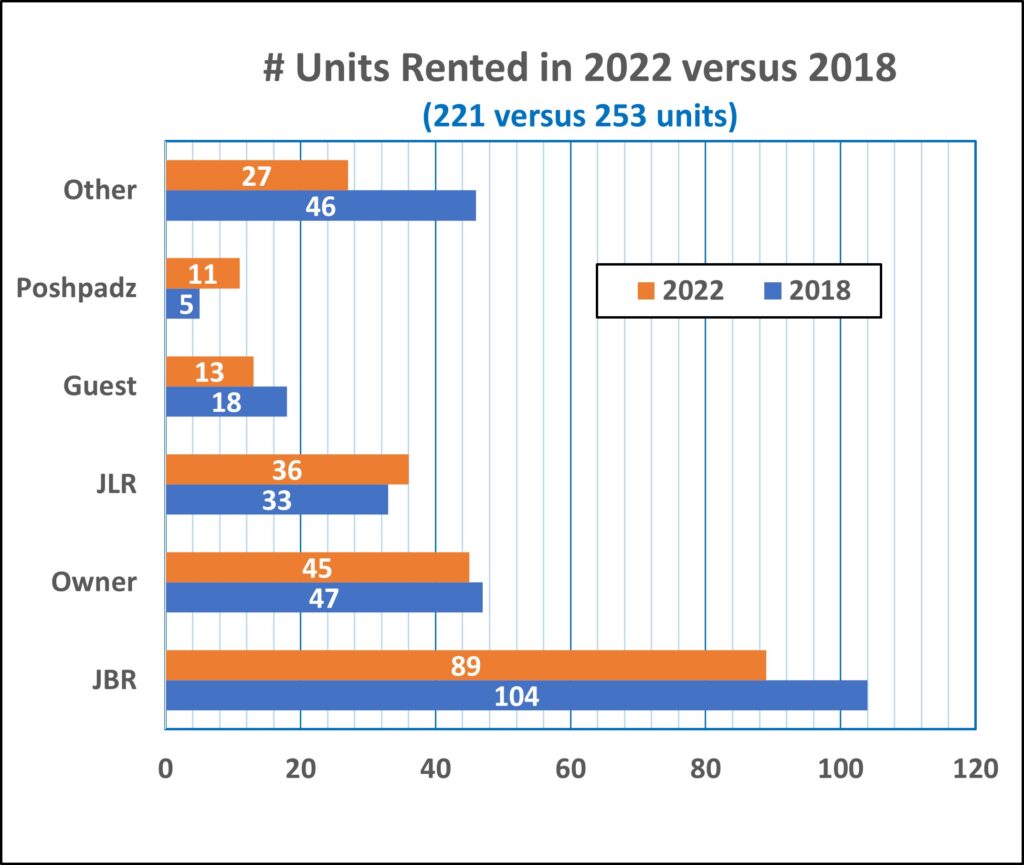

Units Rented in 2022 versus 2018

Rental Agency Changes

- Poshpadz rented 6 more units in 2022 than in 2018, JRL gained 3 units, and JBR lost 15 units.

- In the past 9 years Owner and Owner Guest rentals have increased considerably but have decreased slightly since 2018.

- Agencies renting in Jupiter Bay change frequently. Over the past 4 years 13 have left and 12 were added.

Principal Rental Agencies Used in 2022

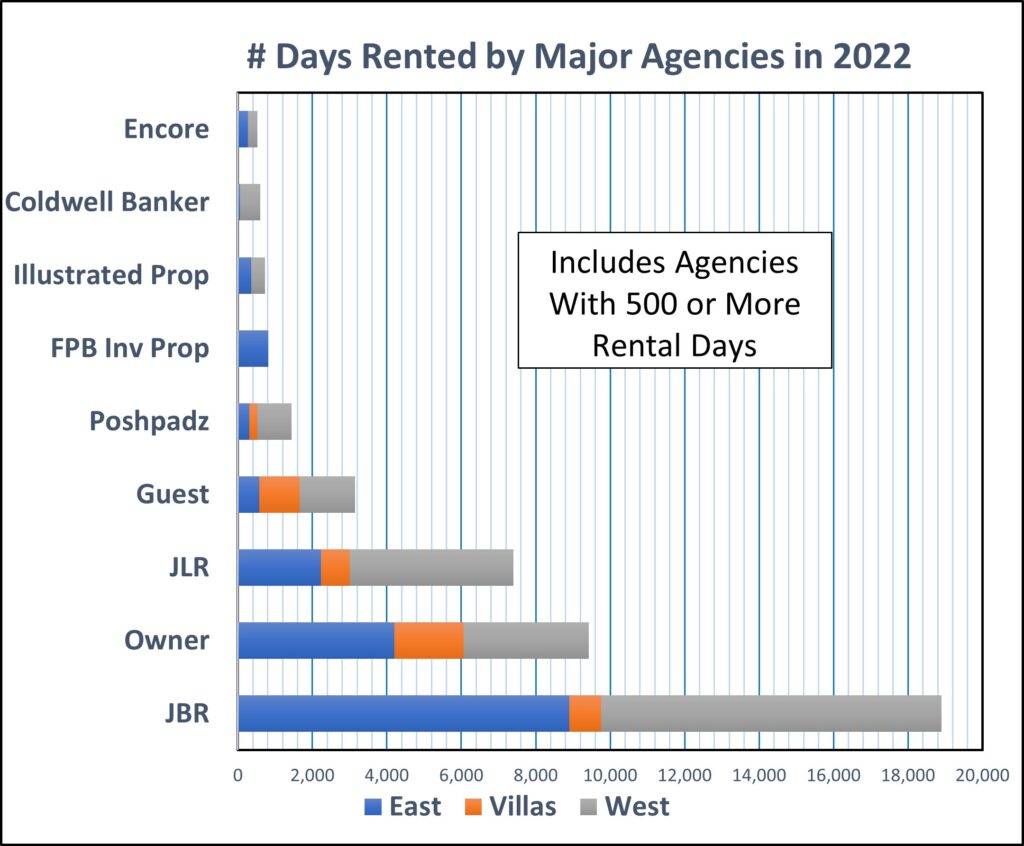

Total Days of Unit Rentals

- This chart shows days rented by agency for the top 7 agencies used in 2022 plus days rented by owners (to guests or others).

- The remaining 15 agencies had under 500 days of Jupiter Bay rentals.

- Jupiter Bay units were rented for 45,739 days in 2022. This was 4,298 days more than 2018, 5,371 more than 2013 and 19,167 more than 2010.

- Leading renters in 2022 included:

- JBR - 18,906 days rented

- Owner Rentals - 9,432 days

- JLR - 7,406 days

- Guests of Owner - 3,145 days

- Poshpadz - 1,446 days

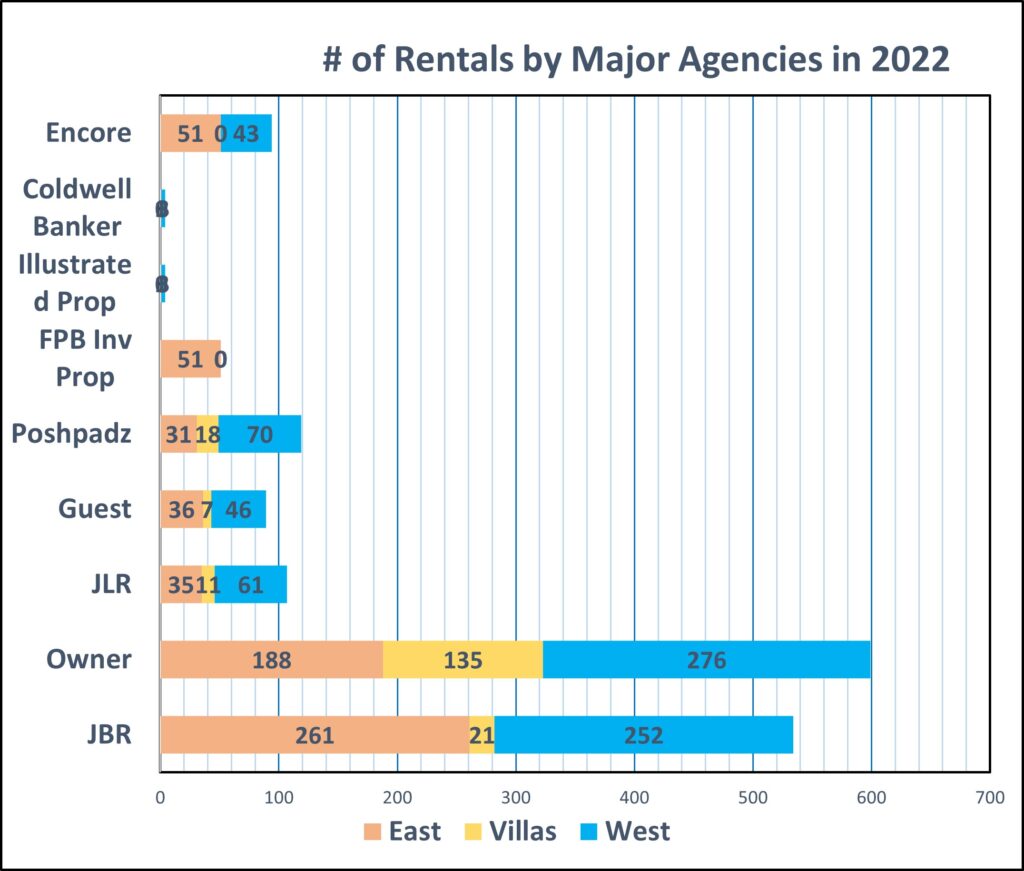

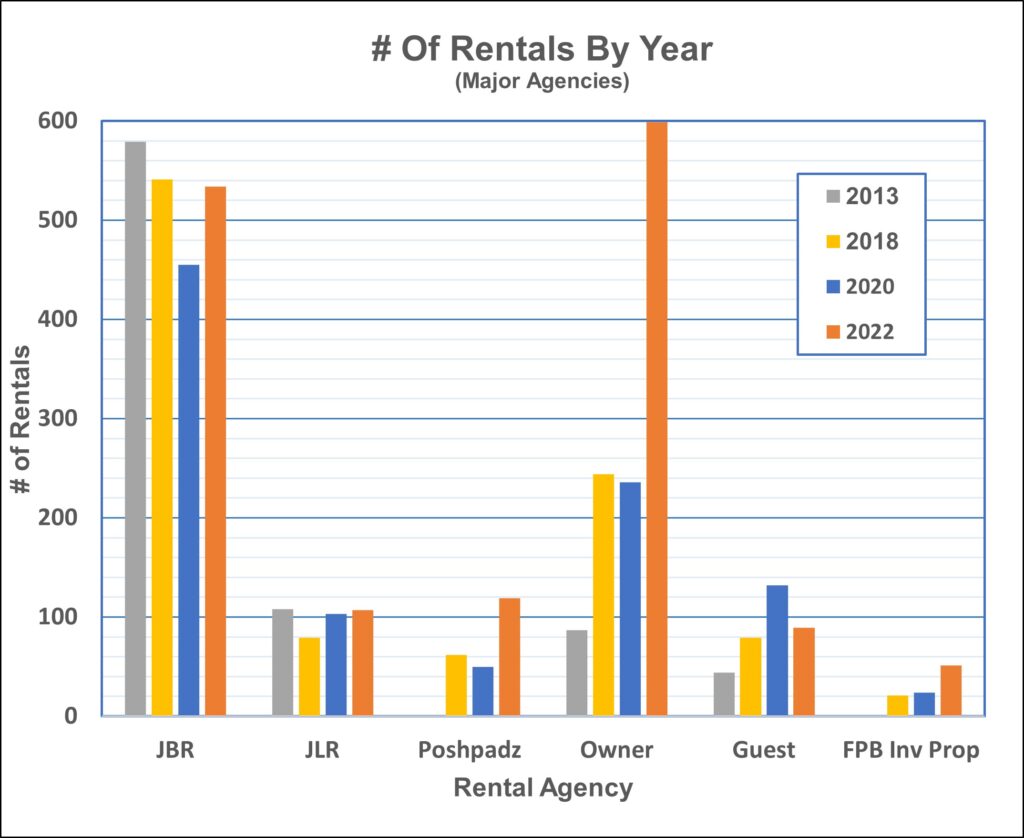

# of Rentals by Principal Rental Agencies

# of Unit Rentals

- This chart shows the number of rentals (# of leases) that each major rental agencies had in 2022.

- Jupiter Bay Owners had the most rentals (599), with Jupiter Bay Resort Rentals (JBR) in second place at 534.

- Three other agencies had over 90 rentals in 2022:

- Poshpadz – 119 rentals

- Jupiter Lighthouse Realty – 107 rentals

- Encore – 94 rentals

Rental by Owner

- With the increase of online condo rental companies, such as Vrbo, Airbnb, Booking.com, Expedia, HomeToGo, and others, more Jupiter Bay owners are renting their own units.

- In 2022, 32.4% of Jupiter Bay condo rentals were by owner, up from 20.9% in 2018. This saved these owners the typical 15 to 20% local agency commission.

- Although, this provides extra net income, it places additional responsibility and tasks on the condominium owner including:

- tenant qualification,

- scheduling,

- lease execution,

- fee collection,

- tax payments,

- record keeping/retention,

- post-rental inspection and

- cleaning.

- Some of these tasks can be performed by the online condo-rental company.

- Fees include security deposit, rental, cleaning and taxes. Both county and state taxes must be collected on any rental of six months or less and forwarded, in a timely manner, to the respective government department.

Important Information Regarding Rentals

• A Guest/Lease Registration Form must be completed for each non-owner unit occupancy and submitted to the Association Office.

• Per FL Statute 718.116(11)a, If a unit is occupied by a tenant and the unit owner is delinquent in paying any monetary obligation due the association, the association can demand that the tenant pay the association the rental payments due and continue such payments until all of the owner’s monetary obligations are satisfied. Delinquency for rental purposes is defined as overdue payments for late fees, interest, attorney fees and assessments as of the rental application date.

• Per FL Statute 718.303(4), The Association has the right to deny delinquent owners and their renters/guests use of common facilities and services including swimming pools, tennis courts, etc. However, no tenant shall be denied access to any available franchised or licensed cable television service.

• Short-Term Rentals: Condominiums rented or leased for 6 months or less in Palm Beach County, require collection of a Tourist Development Tax equal to 6% of the total taxable rental receipts. Failure to collect and pay this tax and the 7% sales tax on unit rentals is a theft of state funds and carries felony charges.

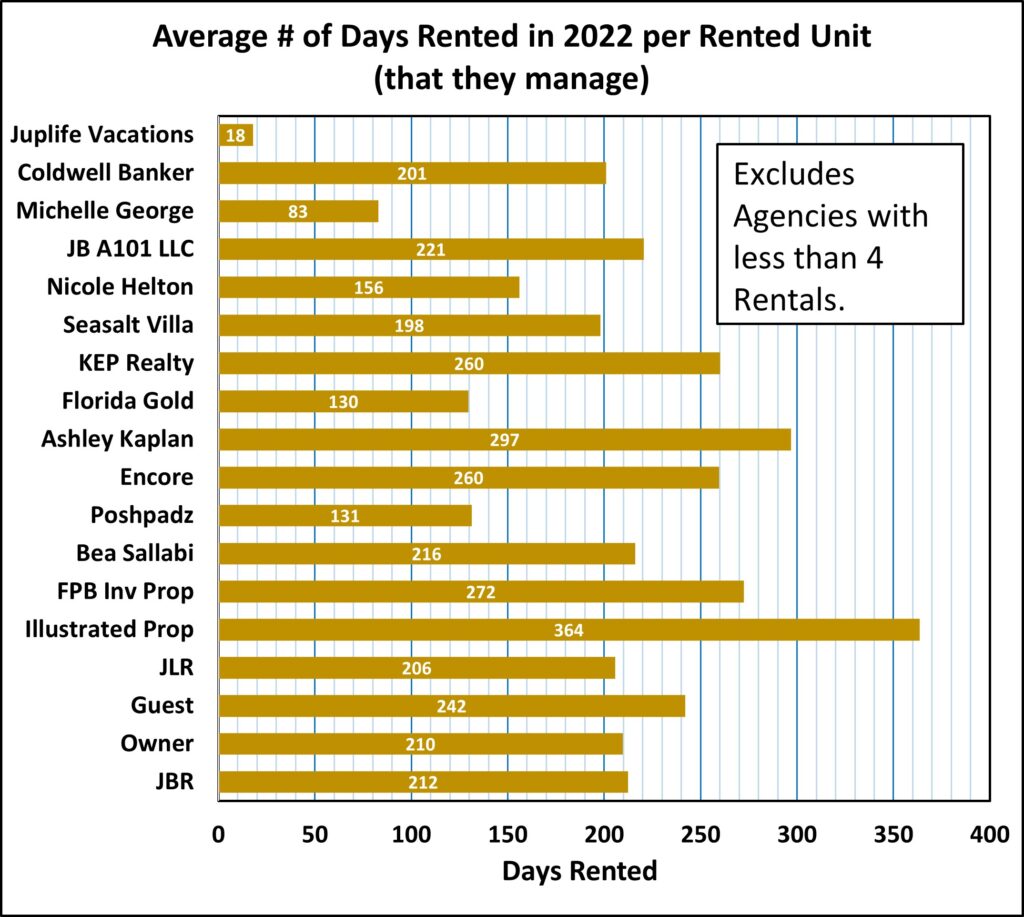

Agency Rentals per Rented Unit in 2022

Days Rented per Rented Unit

- This chart averages all leases that a rental agency has with units that they manage, whereas the next chart looks at days rented for individual leases.

- Illustrated Properties and Ashley Kaplan provided owners whose units they managed the most rental days.

- All but 2 of these agencies provided at lease 3 months of rental income to the owners whose units they managed.

- The average was for 27 weeks (6 months). The 18 annual rentals significantly increased the average.

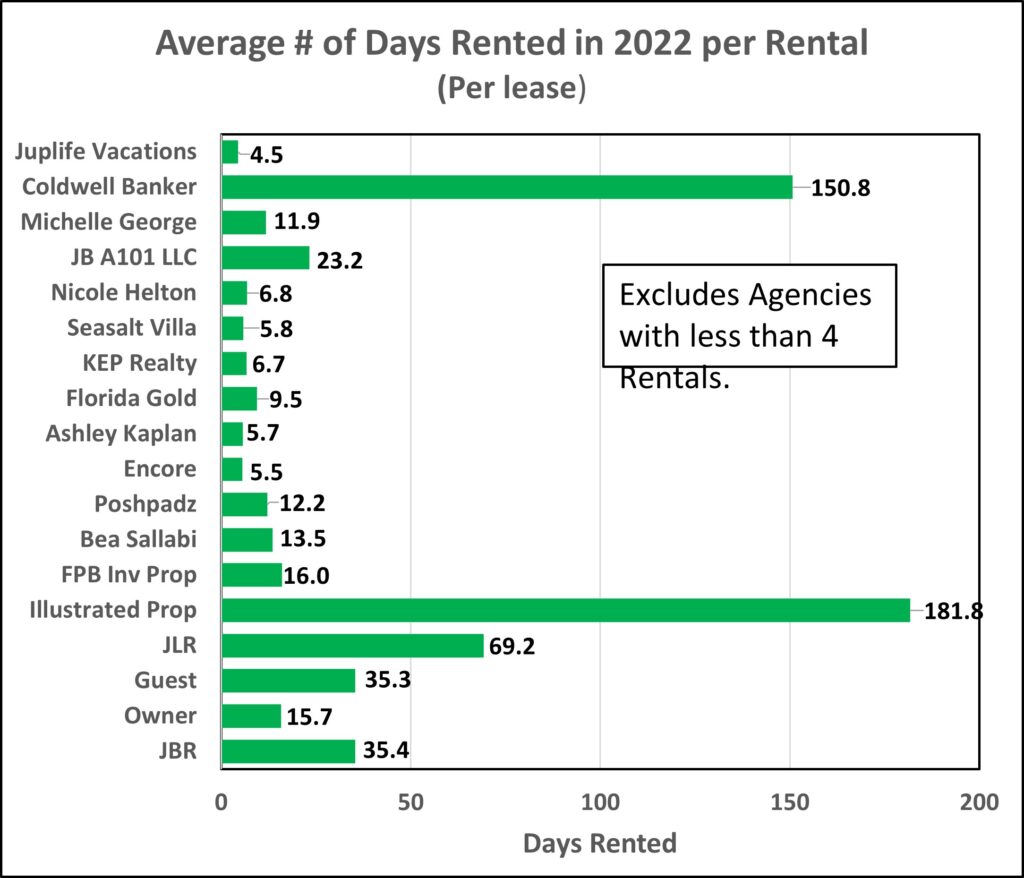

Agency Rentals per Lease

Average Lease Period

- The average 2022 lease was for 24.8 days. The average 2018 lease was for 35 days.

- Coldwell Banker and Illustrated Properties feature long-term rentals averaging approximately 6 months.

- JLR’s average lease was for 2 months (69.2 days) whereas JBR’s was for approximately one month (35.4 days).

- The average owner rental was for 16 days. Although many rentals were for 1-3 days, 8 annual owner rentals significantly increased the average.

- 7 agencies averaged weekly rentals.

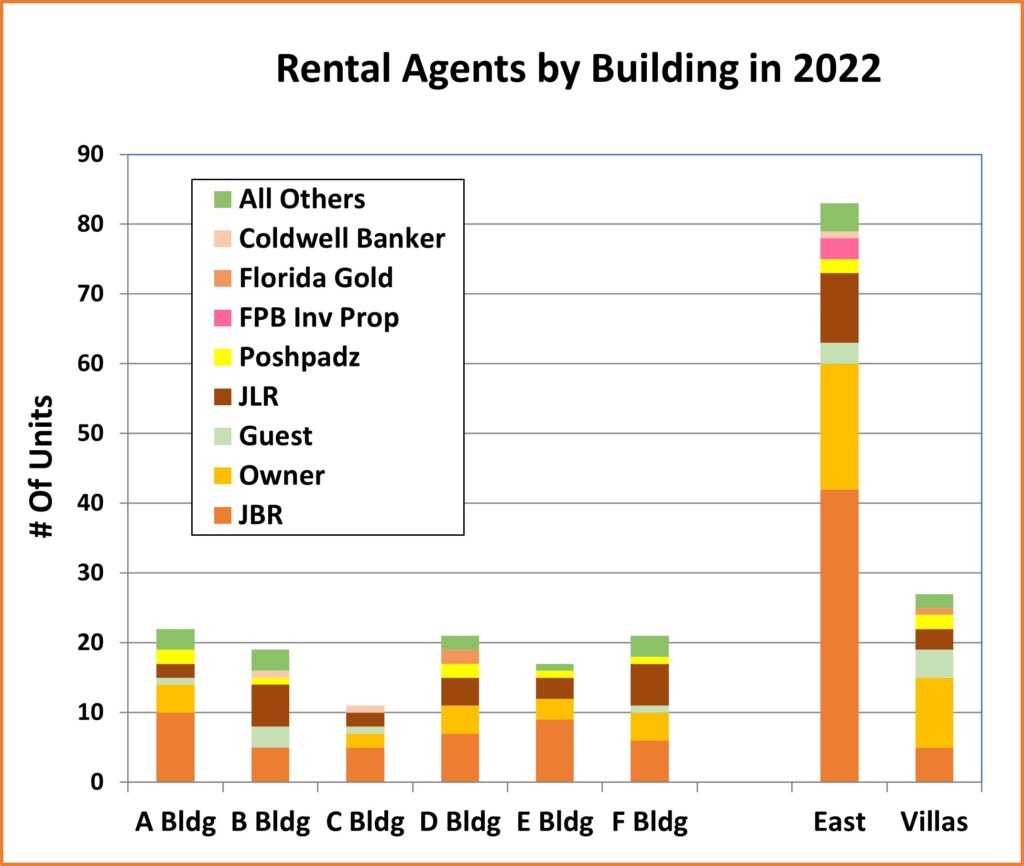

Rental Agents by Building

Rental Agent Usage

- Rental agencies were used by 88 West owners, 62 East owners and 13 Villa owners.

- 17 West owners, 18 East owners and 10 Villa owners did their own rentals.

- FPB Investment Properties only rented in the East.

- Florida Gold did not rent in the East, and Coldwell Banker didn’t rent in the Villas.

- JBR rentals were split between the East & West, whereas JLR primarily rented units in the West.

Annual Number of Jupiter Bay Rentals

# of Rentals is Increasing

- Jupiter Bay had 1,848 rentals in 2022, 680 more than 2018 and 940 more than 2013.

- Owner and Guest of Owner rentals are up significantly, 355 (145.5%) and 10 (12.7%) respectively from 2018.

- Jupiter Bay’s major rental agencies experienced significant changes over the past 4 years:

- JBR – 1.3% decrease

- JLR – 35.4 % increase

- Poshpadz – 91.9 % increase

- The number of rentals at Jupiter Bay is increasing every year (except for 2020). They’re up 97.9% since 2013.

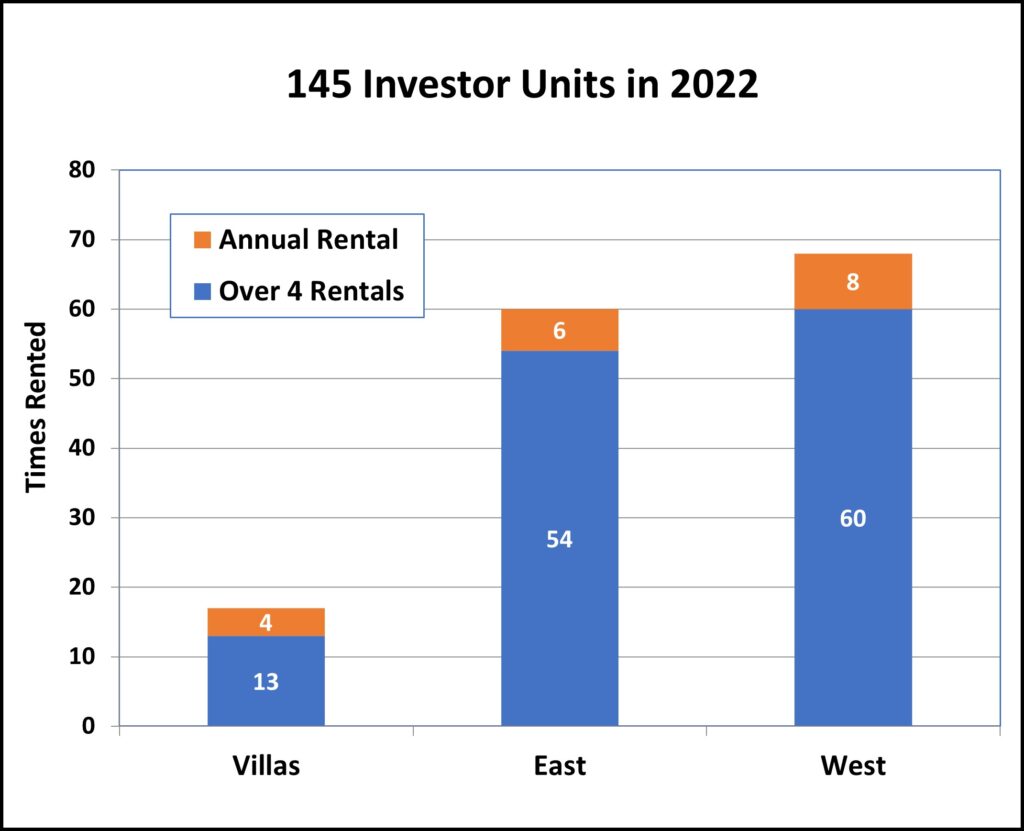

Jupiter Bay's Investor-Owned Units

Investor Units by Association

- I define an investor unit as a unit rented annually or over 4 times per year.

- By this definition, 145 condominiums (40.4%) are primarily owned as investments but may have some personal use.

- 127 units were rented over 5 times per year in 2022, and 18 had annual rentals.

- This is a 17.9% increase from 2018:

- +19 units over 5 rentals

- +3 annual rental units

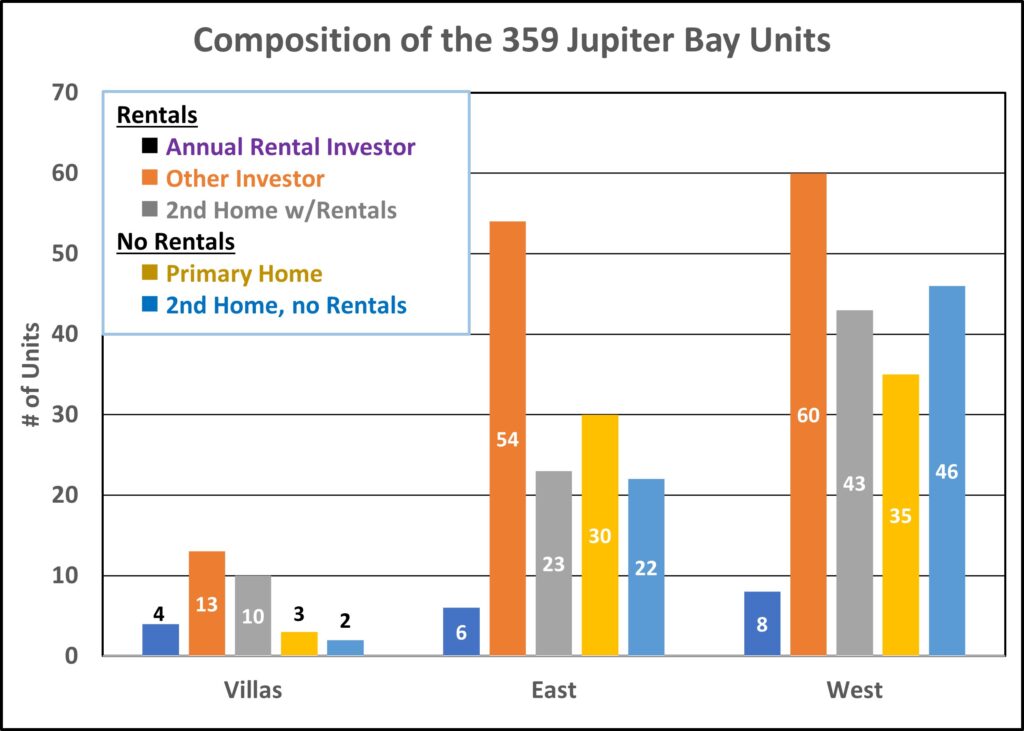

Jupiter Bay's 2022 Composition of Units

Composition of Units

- 221 of Jupiter Bays Units were rented in 2022:

- 18 – Annual Rental Units

- 127 – Other Investor Units

- 76 – 2nd Homes w/some rentals

- 138 Units were not rented in 2022:

- 68 – Primary Homes

- 70 – 2nd Homes Not Rented

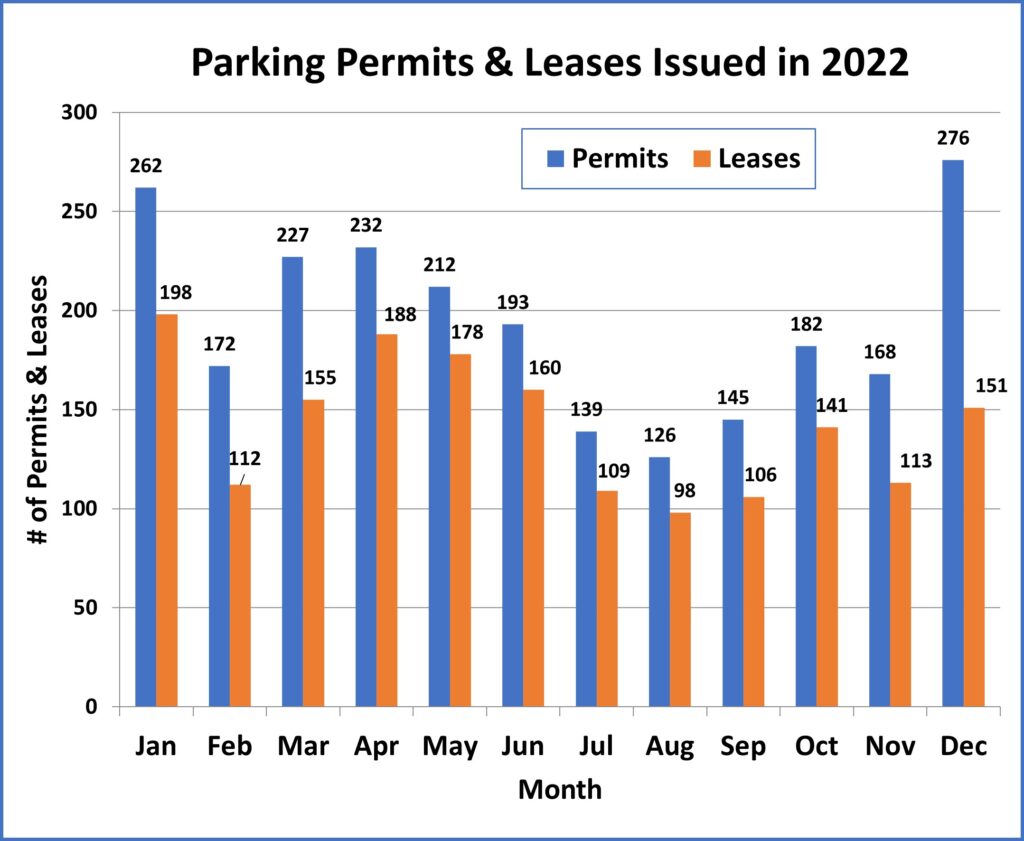

Parking Permits & Leases

Monthly Permits/Leases

- 2,334 parking permits and 1,848 leases were processed through the Association's Office in 2022.

- Over 160 leases per month (approximately 7 per workday) were issued from December 2021 through May 2022.

- Most leases were processed in January (198 leases) and most permits in December (276).

- August was the slowest month, with 126 permits and 98 leases.

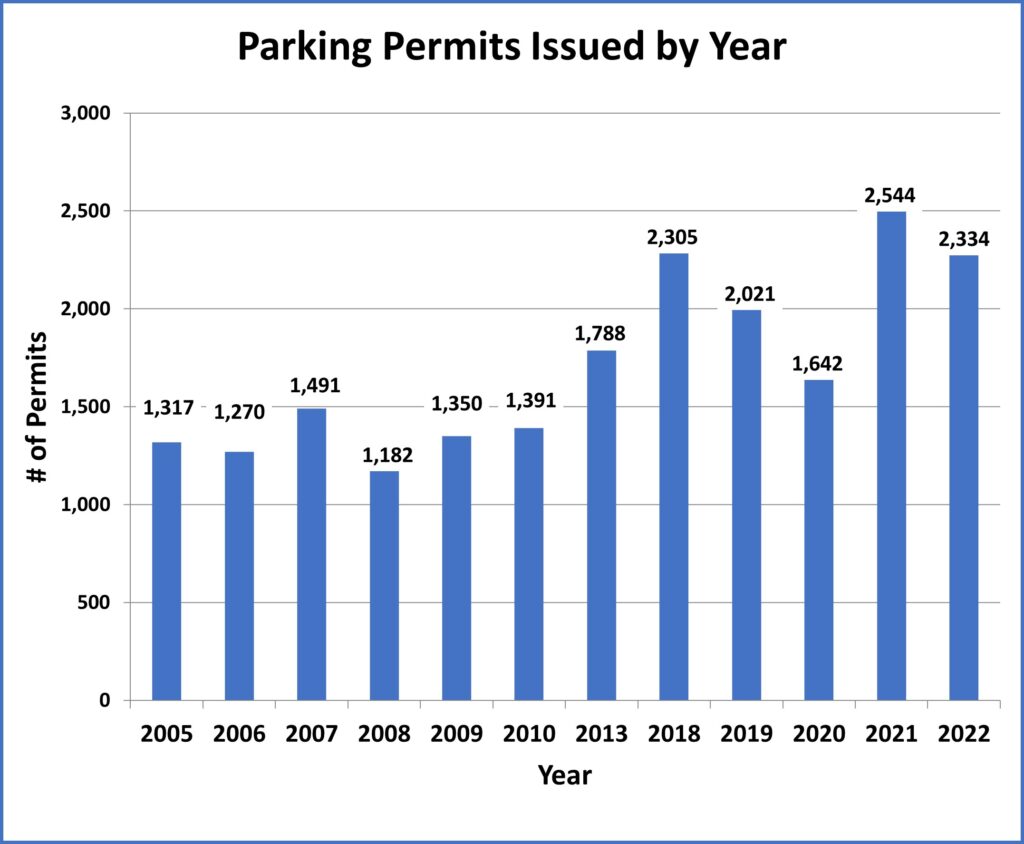

Annual Number of Parking Permits

2022 Parking Permits

- 2,334 parking permits were issued in 2022, approximately 9 issued per workday.

- 1,848 permits were issued for leases and 486 for other reasons.

- Except for 2020 (Covid year) over 2,000 parking permits were issued during each of the past 5 years.

- The increase is driven by increases in condominium rentals, shorter rentals, owner families/guests, and additional 2nd and 3rd car registrations.

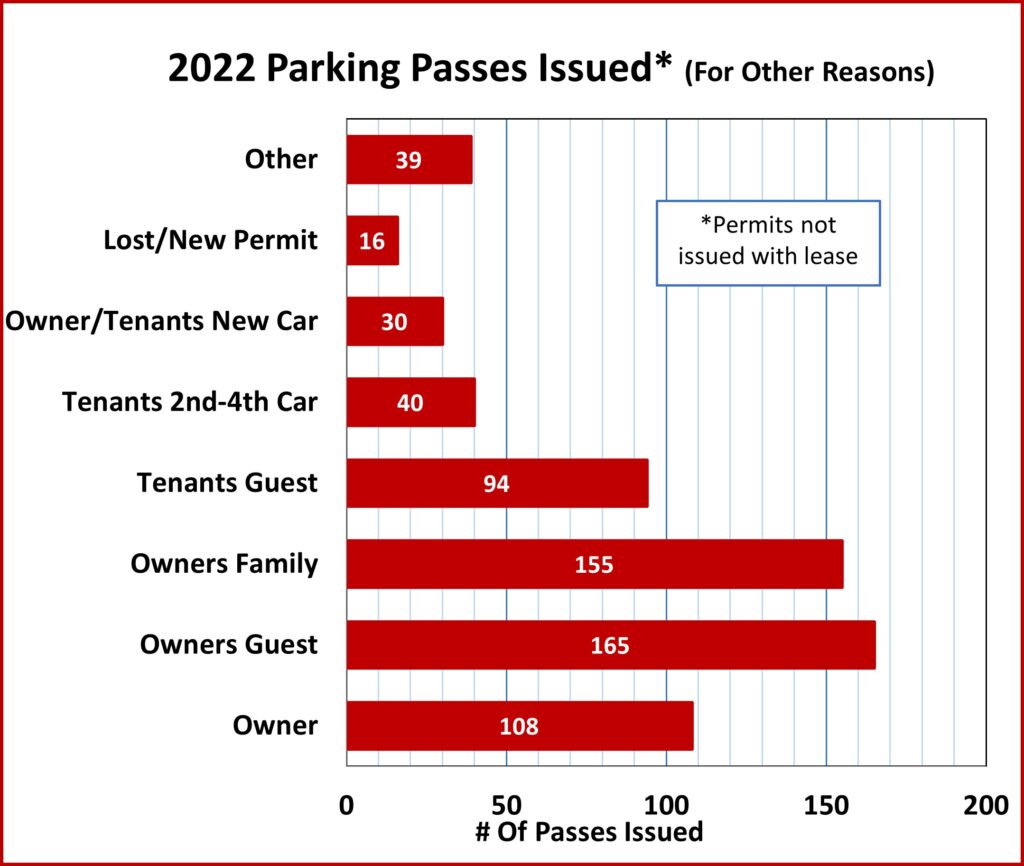

Non-Lease-Related Parking Permits

Leases Only Accounted for 72% of Permits

- As this chart shows, 647 parking permits were issued for reasons other than a new lease.

- Owners were issued 460 of these non-lease related permits and Tenants were issued 187.

- Note the number of parking permits issued to Tenants with 2, 3 or 4 cars (40) and the number of permits issued to Tenant’s Guests (94).

- The 108 were issued to owners occupying their own unit.

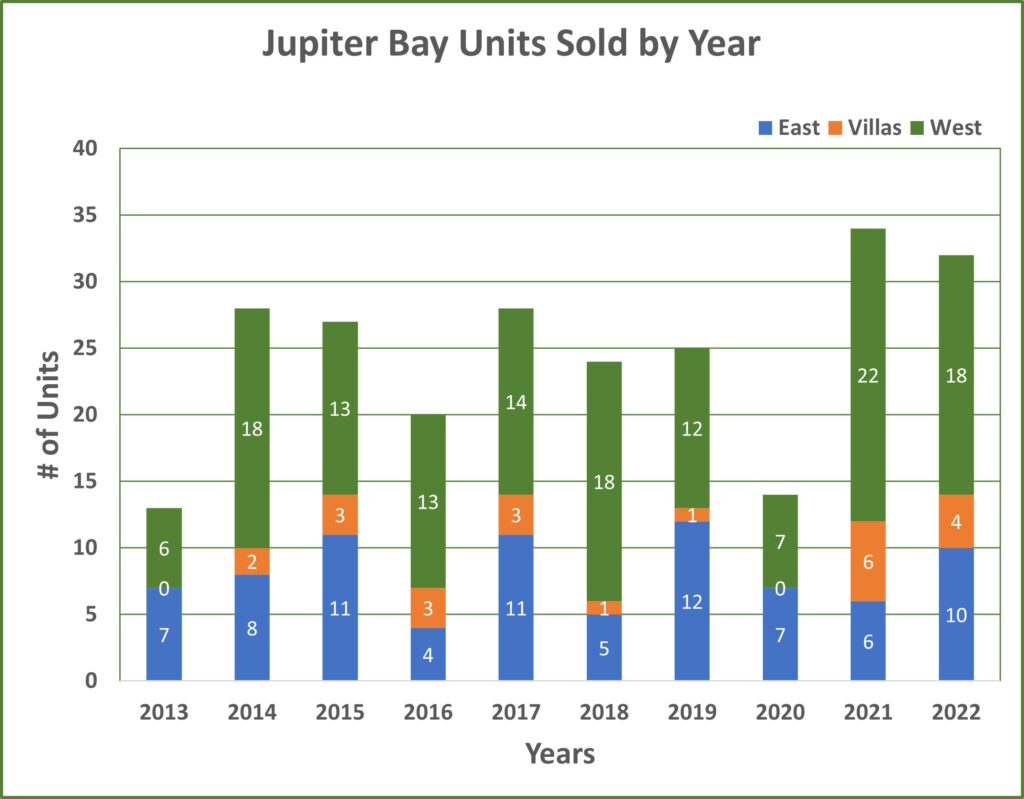

Jupiter Bay Condo Turnover is Increasing

More Own Multiple Units

- 245 condominium units were sold over this 10-year period.

- Sales averaged 24.5 units per year or 6.8% of the total Jupiter Bay units.

- Over this period 46 units sold twice, 7 sold 3 times, and one sold 4 times.

- As of April 2023, 26 owners owned more than one condominium unit:

- 21 owned 2 units

- 2 owned 3 units, and

- 3 owned 4 units.

- 5 years ago, 19 owners owned more than one unit: 16 owned 2 and 3 owned 3.

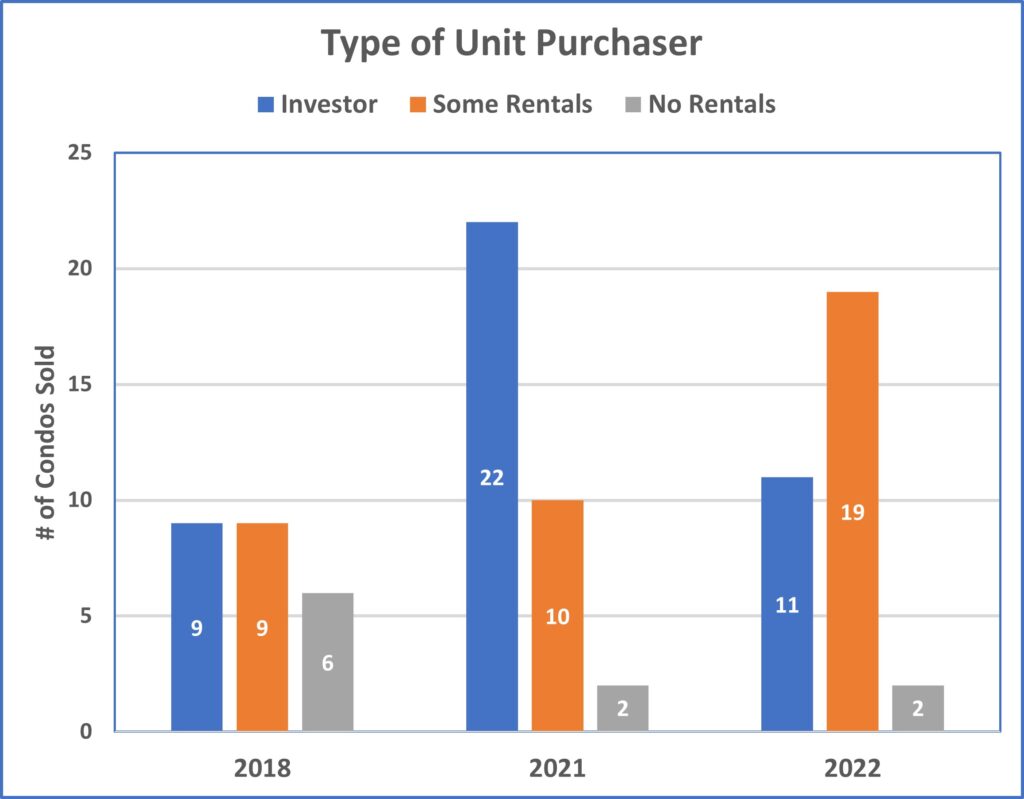

Purchasers of Jupiter Bay Condos

Most Jupiter Bay Units are being Purchased for Rental Income

- Investor is defined as an owner who rents their unit 5 or more times a year or has annual rentals.

- Most new Jupiter Bay condo owners are either Investors or do some (1-4) rentals each year.

- In 2018, 25% of Jupiter Bay condo purchasers did not rent their units. In 2021 and 2022, only 6% of purchasers did not rent their units.

- 50% of recent (2021-2022) condo purchasers are investors.

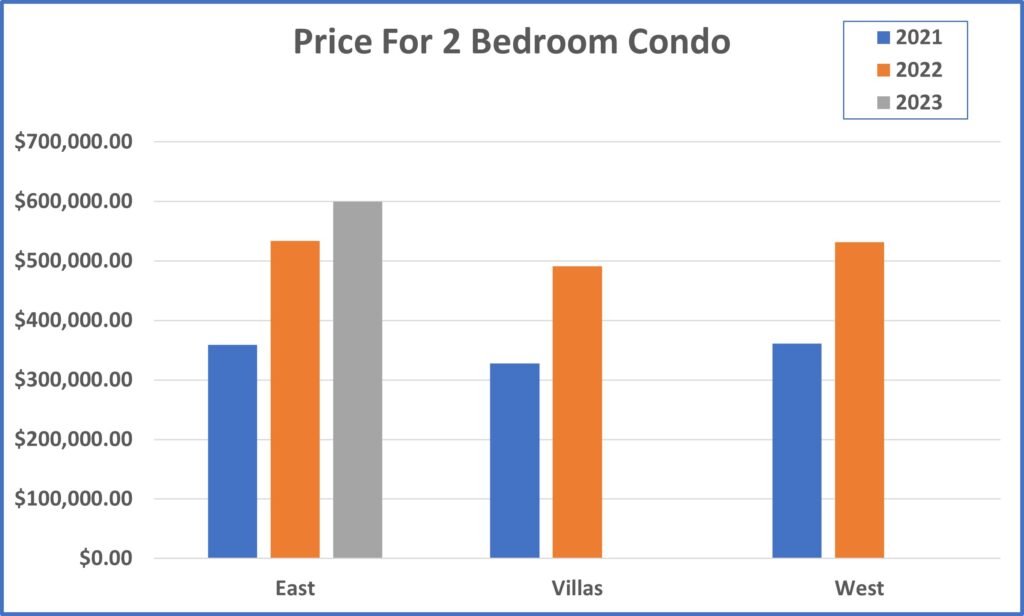

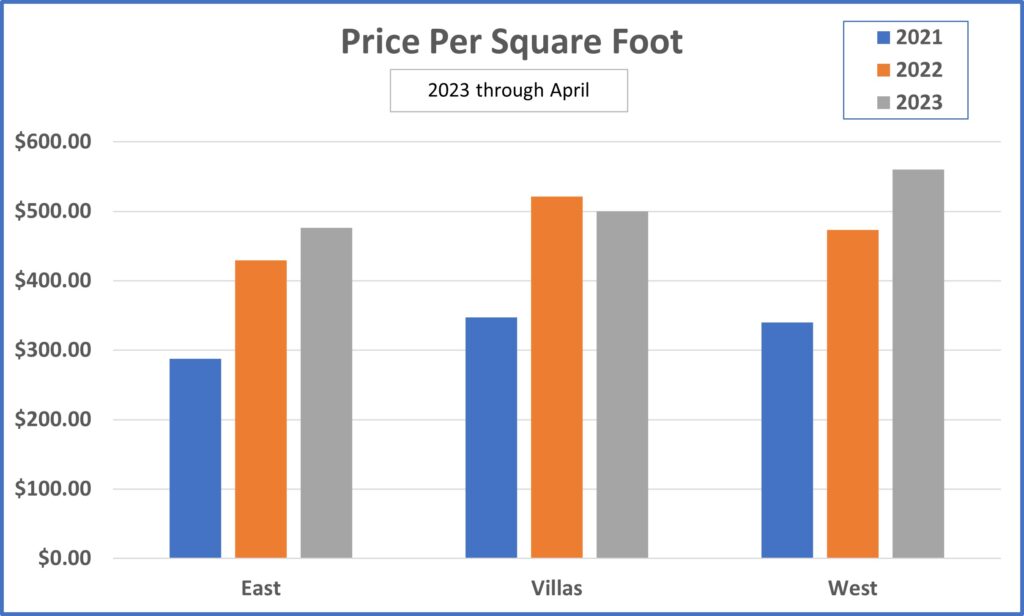

Jupiter Bay Condo Price

The Price of Jupiter Bay Units is Skyrocketing

- Two-bedroom condominiums that sold for under $300,000 4 years ago are now selling for over $500,000.

- This is a 67% price increase over this period.

- One-bedroom units, not shown here, are experiencing a similar price increase.

- East & West units are pricier than Villa units.

- Units on the higher floors of the East and West buildings generally sell for a premium.

- Two-story West townhouses are the largest and priciest units at Jupiter Bay.

Jupiter Bay Condo Price per Sq Ft

Jupiter Bay Condos are Selling for $500 per Sq Ft

- The square footage of one and two-bedroom condos varies by Association/Building.

- Here's the square footage of two-bedroom units:

-

- 1,250 East

- 1,056 West (excluding townhomes)

- 925 Villas

-

- Here's the square footage of one-bedroom units:

-

- 900 East

- 821 West (excluding townhomes)

- 662 Villas

-

- West townhomes have 1,374 square foot.

- Since the Villas have less square footage, their price per square foot is comparable to the other buildings.

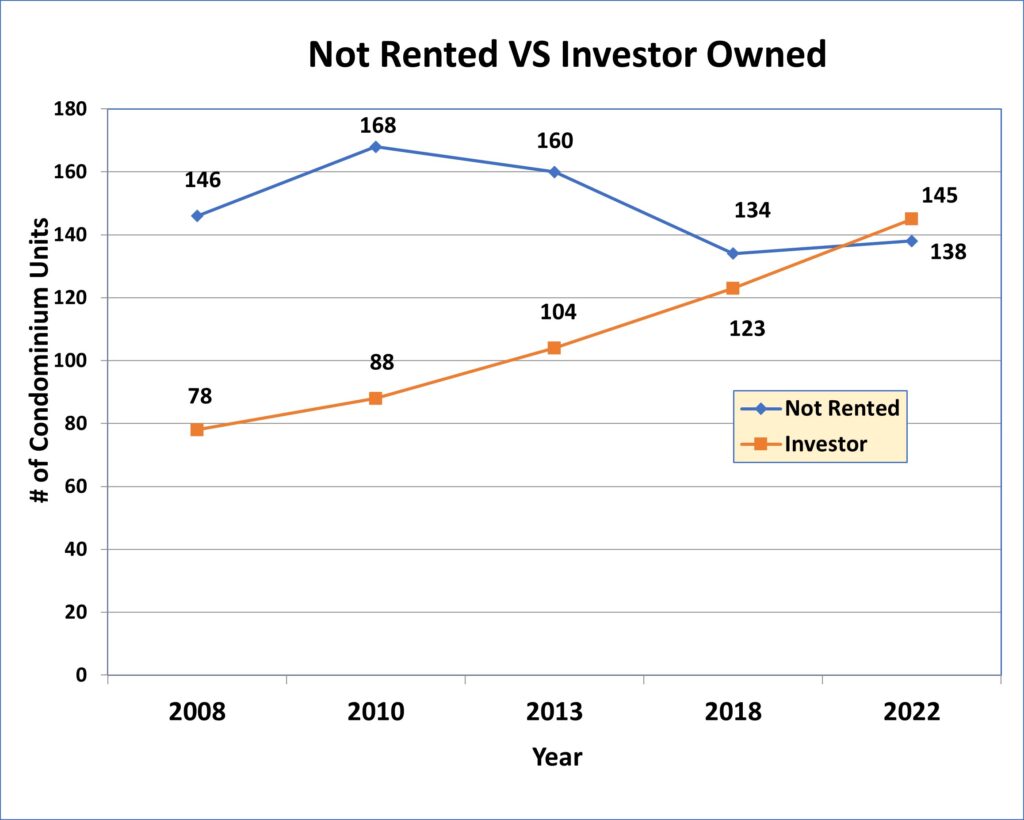

Condominium Usage (14-Year Period)

Investor-owned is exceeding Not-Rented

- Rentals of existing units is increasing, and more investors are purchasing units.

- For the first time, the number of investors is exceeding the number of owners who do not rent their units.

- In 2008, 40.7% of units were not rented, this dropped to 37.3% by 2018. It’s now up slightly to 38.4%.

- In 2008, 21.7% of units were used as investments, this increased to 34.3% by 2018 and is now at 40.4%.

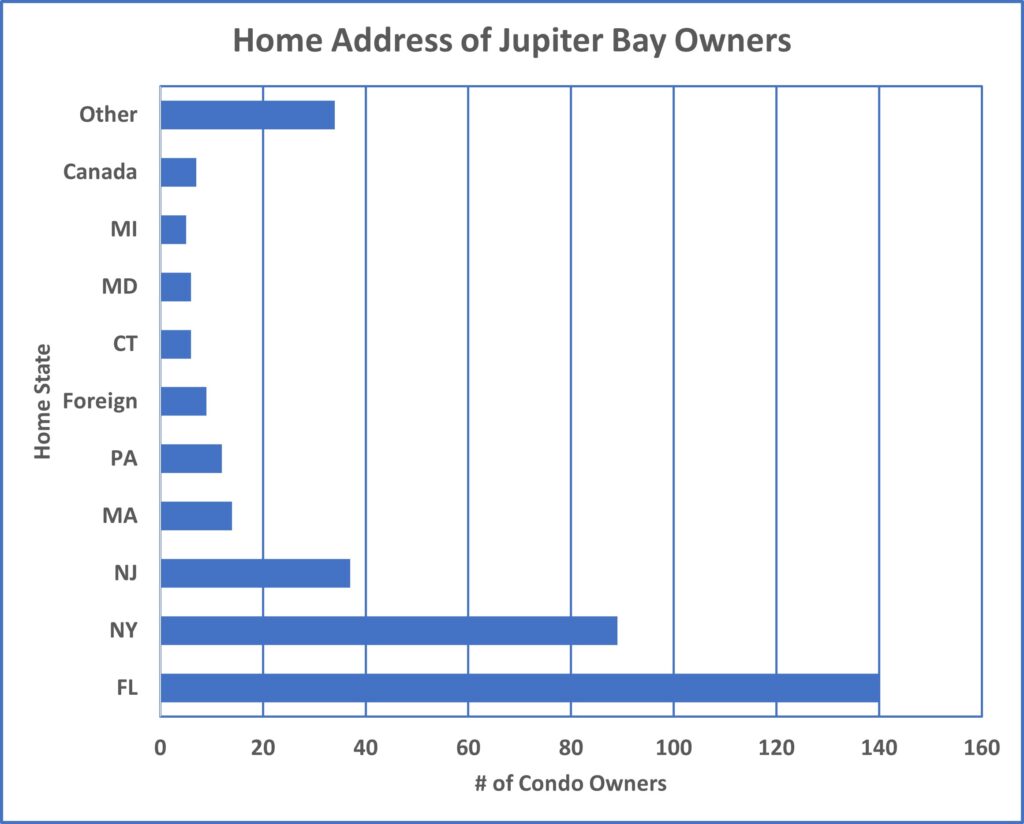

Home Addresses of Jupiter Bay Owners

JB Owners Represent 30 of the 50 States

- 10 or more owners are from Florida, New York, New Jersey, Maryland & Pennsylvania.

- The “Other” category includes 21 states.

- The highest percentage (39.0%) of Owners have Florida primary addresses. This is up 3.3% from 2018.

- 35.1% of Jupiter Bay Owners list their primary address as New York or New Jersey.

- Foreign unit owners include Belgium (1), France (1) and Spain (1) and Argentina (6).

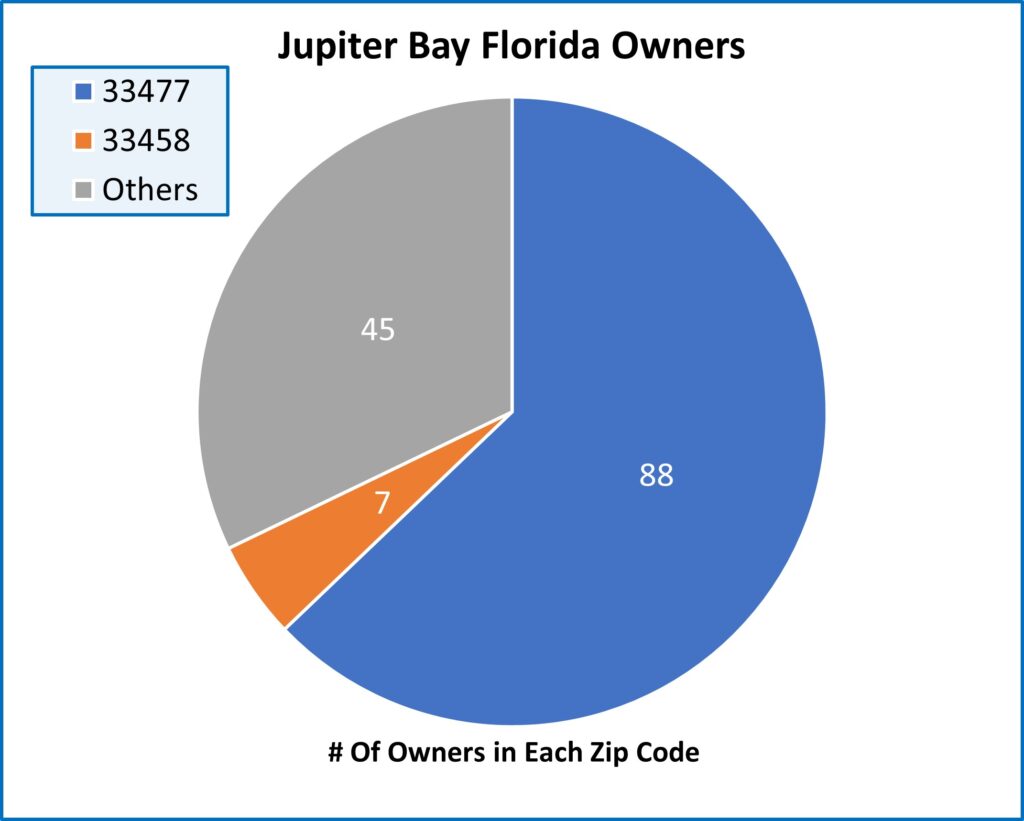

140 Jupiter Bay Owners have Florida Addresses

35.7% of Owners are Floridians

- Of the 138 Owners who didn’t rent their units at all in 2022, 50 of them list their Jupiter Bay address as primary.

- 51 Owners live in elsewhere in Jupiter, including zip codes 33477 (13) and 33458 (6) but lease units in Jupiter Bay.

- The “Other FL” category includes owners from 24 Florida zip codes.

Rental Agencies Added / Deleted

|

Agencies Not Leasing in 2018

|

Agencies Not Leasing in 2022

|

Agencies Added Since 2013

|

Agency/Owners Renting Over 40 Times in 2022

| Agency/Owner | Times Rented in 2022 | Total Days Rented | Unit Location | Average Days Rented | Unit Acquired |

| Owner #1 | 52 | 311 | West | 6.0 | 2021 |

| Owner #1 | 51 | 320 | West | 6.3 | 2021 |

| Agency #1 | 51 | 273 | East | 5.4 | 2020 |

| Owner #1 | 50 | 299 | Villa | 6.0 | 2016 |

| Owner #2 | 49 | 280 | East | 5.7 | 2002 |

| Owner #1 | 48 | 294 | Villa | 6.1 | 2019 |

| Agency #2 | 48 | 252 | Villa | 5.3 | 2021 |

| Agency #1 | 43 | 246 | West | 5.7 | 2021 |

Conclusions

- Except for West C building, Jupiter Bay has extremely lax rental policies, restricting only size of pets, type of vehicles and number of unit occupants. No lease approvals nor transfer fees (except West C) are required.

- The number of units rented in all buildings except West C has increased over the last 4 years, from 60.7% to 61.6%. West C rentals decreased by 2 units.

- The average number of rentals per unit has increased (40 units rented 10 times or more) and rental length has decreased (650 rentals less than a week) trending toward a hoteling community. Short term rentals (<7 days) increased almost 200% from 2018.

- Eight Units were rented more than 40 times in 2022 with rental periods averaging 5-6 days. Five of these units were acquired in the last 3 years.

- Although 2 fewer owners rented their units in 2022, the number of owner rentals increased. These rentals were 32.4% of total 2022 rentals, up from 20.9% in 2018.

- There continues to be significant turnover among agencies renting Jupiter Bay units. From the 2013 agency list, 7 dropped out in 2018 and another 13 by 2022. Over this period 17 new agencies were added.

- Jupiter Bay Resort (JBR) and Jupiter Lighthouse Realty (JLR) continue to lead in number of days rented with 18,906 and 7,406 respectively. Both have increased their rental days from 2018 numbers, with JLR having the greatest increase (2,277 days). Poshpadz continues to make inroads with 1,446 rental days achieved through 119 leases.

- JLR’s average lease is for 2 months, JBR’s is for one month and Poshpad’z is for 2 weeks.

- The number of investor units increased 17.9% from 2018, now totaling 145 (40.4% of all JB units). 138 units were not rented at all in 2022, and 68 of these are believed to be principal residences. For the first time, more units were are owned by investors than by owners who don’t rent.

- Jupiter Bay is becoming an investor/tenant community instead of a primary/secondary home community. With its lax rental policies, Jupiter Bay condominiums continue to be a top choice for investors.

- 2,334 parking permits were issued in 2022, slightly less than 2021 and slightly higher than 2018. This calculates to approximately 9 permits per workday.

- 245 Jupiter Bay condominium units were sold over the last 10 years, with sales increasing significantly over the last 2 years (2021 & 2022). The number of people owning multiple condos has increased significantly with 26 owning more than one unit, up from 19 five years ago. We now have 2 people owning 3 units and 3 owning 4 units.

- One final point of interest, 51 of our condo owners live elsewhere in Florida, and most of them rent their condo as an investment.